Business Verticals

We bring together engineering expertise, technological innovation, and a wealth of knowledge to deliver comprehensive solutions. From advanced engineering services to cutting-edge technology development and sharing valuable insights, we cater to diverse industries. Our integrated approach ensures sustainable and efficient solutions that drive success and growth for our clients.

IT Advancement: Igniting Innovation, Transformation, and Business Growth for the Digital Era.

Engineering Excellence: Unleashing Innovation and Precision to Engineer Real-World Solutions for a Dynamic Future.

Knowledge Empowerment: Unlocking Insights, Expertise, and Growth Potential for an Enlightened Future.

Offerings

Unlock the potential of your business with our comprehensive range of offerings. From IT products and services that streamline your operations to expert engineering services that drive innovation, we deliver tailored solutions to meet your unique needs. Experience the power of technology and engineering working together to propel your success.

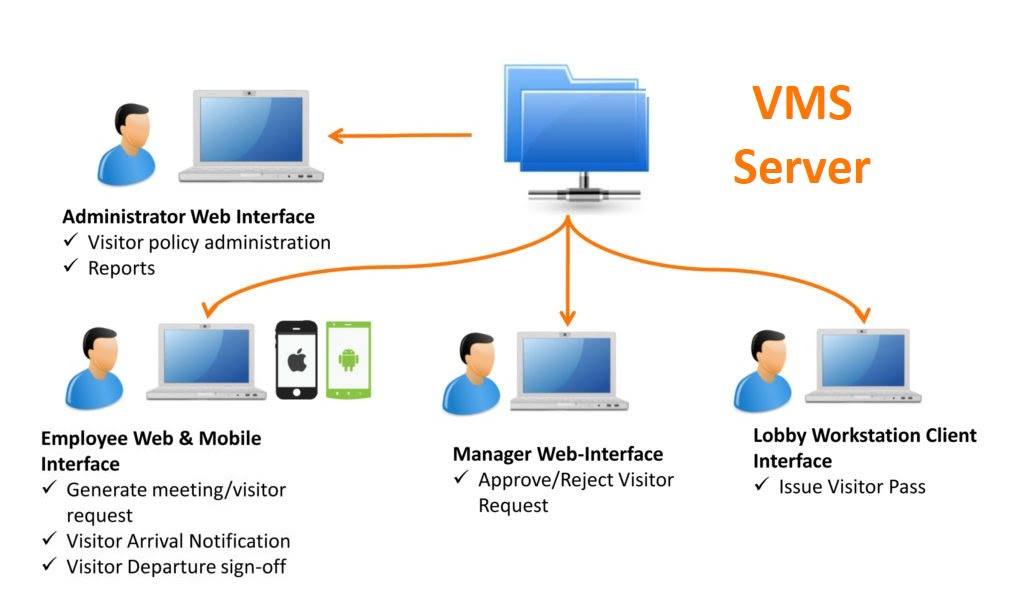

Visitor Management

Smart Visitor Management System, revolutionizing visitor oversight with secure, efficient, and user-friendly solutions. Say goodbye to manual logbooks and embrace streamlined processes, real-time monitoring, and enhanced security. Experience a modern approach to visitor management, saving time, enhancing experiences, and ensuring a safe environment

Features at a glance:

- Enhanced security with real-time monitoring and access control.

- Streamlined visitor registration and check-in process for efficiency.

- Time and cost savings through automated processes.

- Elimination of manual logbooks, reducing errors and improving efficiency.

- Improved visitor experience with a user-friendly interface.

- Centralized data management for easy retrieval and reporting.

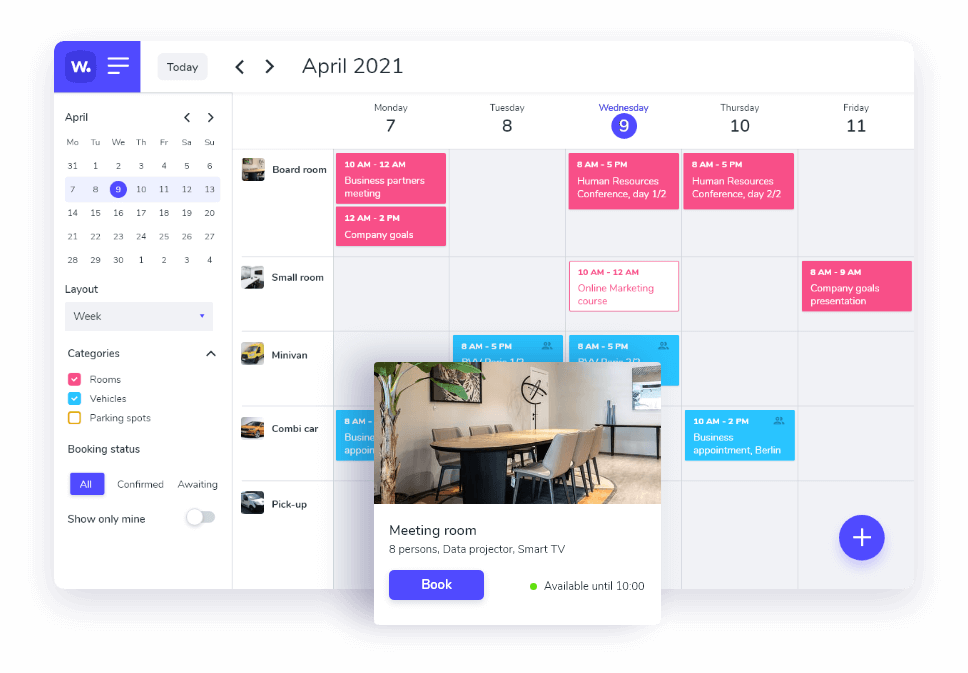

Meeting Room Management

Unlock the potential of your meeting spaces with our Meeting Room Management solution. Experience efficiency, seamless coordination, and exceptional meetings that drive productivity and collaboration. Optimize your meetings with our solution. Streamline scheduling, coordination, and resource allocation for seamless efficiency. Enjoy real-time insights and effortless booking. Elevate your meeting experience.

Features at a glance:

- Real-time visibility into room availability, eliminating conflicts.

- Easy scheduling and intuitive interface for meeting room booking.

- Automated check-in for hassle-free meeting start.

- Powerful analytics for optimized resource allocation and data-driven decisions.

- Customizable display panels for room coordination and information.

- Seamless integration with existing systems for hassle-free implementation.

Bulk Email & Analytics

Revolutionary Bulk Email & Analytics solution. Streamline campaigns, gain deep insights, and achieve remarkable success effortlessly. Create, send, and track mass emails with ease. Leverage comprehensive analytics, automate workflows, and ensure compliance. Seamlessly integrate with CRM and marketing automation for maximum efficiency. Elevate your strategy and engage your audience effectively. Unleash the power of our solution for unparalleled email marketing excellence.

Features at a glance:

- Streamline campaigns, gain insights, and achieve success with our Bulk Email & Analytics solution.

- Elevate strategy, engage effectively, and unlock email marketing potential.

- Automate workflows, personalize templates, and maximize campaign impact.

- Simplify email creation, delivery, and tracking with comprehensive analytics.

- Ensure compliance, manage opt-outs, and tailor subscriber preferences easily.

- Seamlessly integrate with CRM and marketing automation for efficient email marketing.

Incident Ticket

Incident Ticket Management System streamlines issue resolution and improves customer satisfaction. Users can report problems, request assistance, and submit service tickets in one centralized hub. Efficiently manage incidents for timely resolution and enhanced communication. Key features include:

Features at a glance:

- Efficient Ticket Logging: Easily create and log detailed tickets.

- Communication and Collaboration: Seamless communication for timely updates.

- Automated Ticket Assignment: Intelligent assignment based on predefined rules.

- Prioritization and Escalation: Categorize and prioritize tickets, escalate critical issues.

- Knowledge Base Integration: Access relevant articles and FAQs for self-service.

- SLA Management: Track adherence to response and resolution timeframes.

Lead Management

Our Lead Management Solution is a powerful tool designed to streamline and optimize the process of managing leads for your company. It provides a centralized platform for organizing, tracking, and nurturing leads, ultimately enhancing your sales and marketing efforts.

Features at a glance:

- Lead Capture: Effortlessly collect leads from various sources, such as web forms, social media, and emails, ensuring no opportunity is missed.

- Lead Tracking: Gain real-time insights into the status of each lead in the sales pipeline, allowing for better decision-making and prioritization.

- Customizable Dashboards: Tailor the interface to your specific needs, allowing you to focus on the metrics and data that matter most to your business.

Organisation Newsletter

Elevate internal communication with our Organization Newsletter Software, a dynamic solution designed to enhance connectivity and engagement within your organization. Effortlessly share updates, news, and achievements, fostering a sense of unity and informed collaboration among team members.

Features at a glance:

- Customizable Templates: Craft visually appealing newsletters with ease using our customizable templates to reflect your organization's branding and style.

- Scheduled Delivery: Plan and schedule newsletter distributions in advance, ensuring timely and consistent communication with your team.

- Rich Media Integration: Enhance engagement by embedding multimedia elements such as images, videos, and interactive content to create a visually compelling newsletter.

Food & Pantry Management

Introducing our Food and Pantry Management Solution, a comprehensive solution designed to streamline and optimize your company's food inventory and pantry management. From tracking supplies to promoting wellness, our software ensures a seamless and organized approach to keeping your team nourished and satisfied.

Features at a glance:

- Inventory Tracking: Effortlessly monitor food and pantry supplies in real-time, reducing waste and ensuring timely replenishment.

- Employee Preferences: Tailor offerings based on employee preferences and dietary restrictions, promoting a healthier and more inclusive workplace.

- Automated Ordering: Simplify procurement with automated ordering features, minimizing manual effort and optimizing stock levels.

Time & Attendance

A Leave Management System is a comprehensive software solution designed to streamline and automate the process of managing employee leaves and time-off requests. This system provides a centralized platform for employees to request leaves, enables managers to review and approve those requests, and ensures accurate tracking of employee leave balances. Some key features addressed by a Leave Management System include:- Leave Request Submission: Streamline leave request process through electronic submission.

- Approval Workflows: Configurable workflows for efficient leave request review and approval.

Inspection Management

Revolutionize your inspection processes with our Inspection Management Software tailored for inspection companies. Streamline workflows, enhance accuracy, and optimize reporting, ensuring a seamless and efficient inspection experience.

Features at a glance:

- Customizable Checklists: Create and tailor inspection checklists to match the unique requirements of different industries and inspection types.

- Mobile Accessibility: Conduct inspections on-the-go with our mobile-friendly platform, empowering inspectors to efficiently capture and upload data from the field.

- Automated Reporting: Generate detailed and professional inspection reports automatically, saving time and ensuring consistency in documentation.

Job Posting & Referral

A comprehensive software solution designed to streamline and optimize the process of job posting, candidate referral, and employee referrals within an organization. This system provides a centralized platform for posting job openings, tracking applications, and leveraging employee referrals to find top talent. Some key features addressed by a Job Posting and Referral System include:- Candidate Management: Centralized database for tracking applicants.

- Job Posting and Distribution: Reach more candidates through multiple channels.

Reward & Recognition

Powerful service that offers organizations a comprehensive platform for acknowledging and rewarding employee achievements. This software enables businesses to track employee performance, customize rewards to meet individual preferences, and promote peer-to-peer recognition. With gamification elements, timely acknowledgment, and managerial approval processes, the software ensures fair and engaging reward distribution. The integration capabilities, data analytics, and mobile accessibility further enhance its effectiveness, making it an essential tool for fostering a culture of recognition and appreciation within the organization:- Timely Recognition: Immediate acknowledgment of exceptional performance.

- Peer-to-Peer Recognition: Encourages colleagues to appreciate each other's efforts.

Learning & Assessment

A Software Service for Learning and Assessment is a comprehensive platform designed to facilitate effective learning and evaluation processes in educational or training settings. This software service combines various tools and features to support learners, educators, and administrators in delivering and assessing educational content. Some key points related to a Software Service for Learning and Assessment include:- Learning Management System (LMS): Central hub for organizing and delivering learning materials.

- Content Creation and Delivery: Tools for creating and delivering engaging learning content.

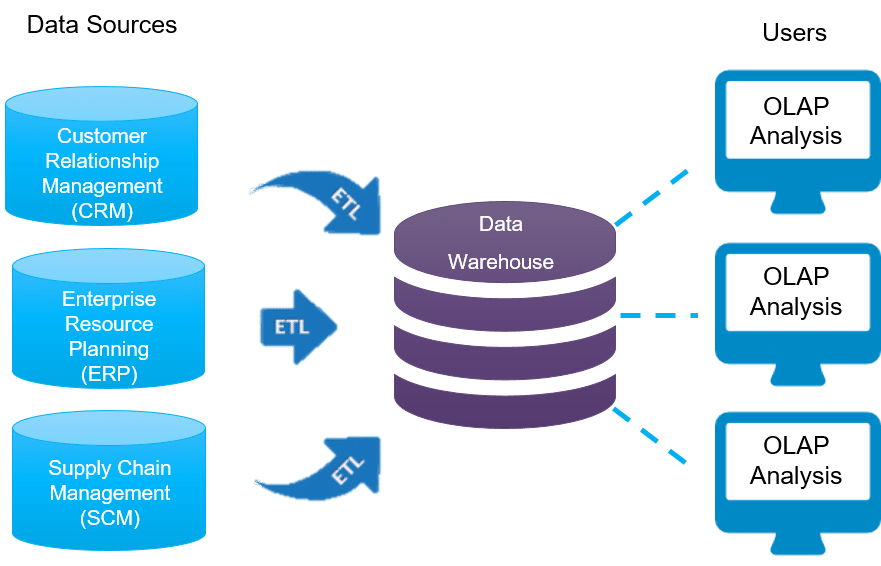

Data warehouse & Analytics

Our comprehensive solution merges cutting-edge technology, robust infrastructure, and expert insights to empower your business in the data-driven era. Centralize your data, seamlessly integrate, and access it easily. With advanced analytics, uncover valuable insights, make data-driven decisions, and fuel innovation. Transform your business with our Data Warehouse & Analytics service and stay ahead in today's dynamic landscape.

- Actionable Insights: Uncover valuable insights for informed decision-making and growth.

- Competitive Advantage: Drive innovation and enhance customer experiences for a leading edge.

- Scalability and Performance: Handle large data volumes and complex analytics efficiently.

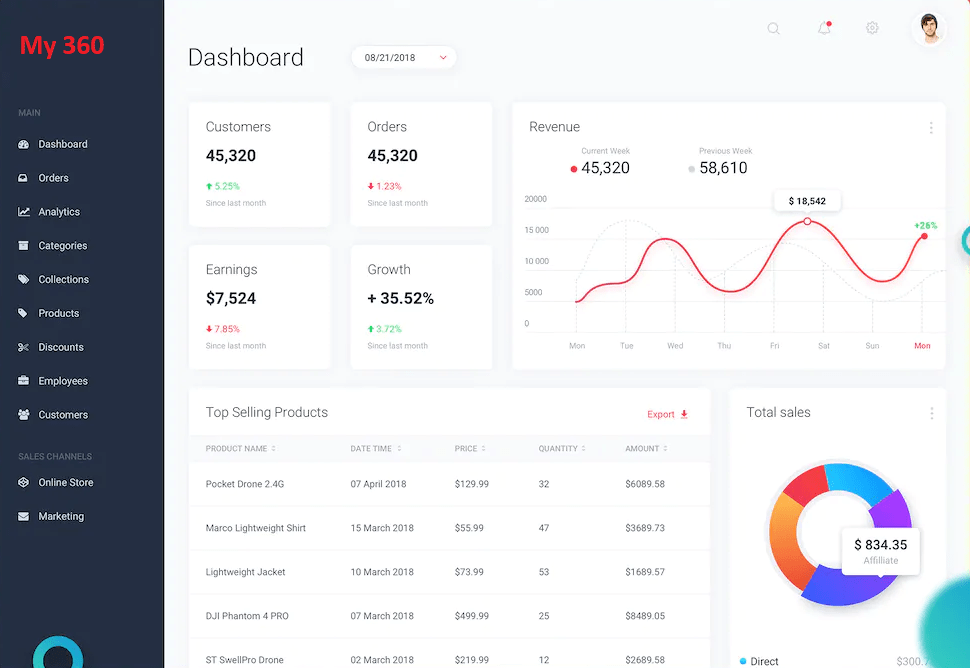

Dashboard & Report Writing

Supercharge your data visualization with our Dashboard & Report Writing service. We specialize in creating captivating and insightful dashboards and reports that transform raw data into actionable insights. Our expert team leverages state-of-the-art tools and visual storytelling techniques to deliver visually stunning and interactive dashboards and reports tailored to your specific needs. Experience the power of data visualization with our service and unlock the potential of your data to drive informed decision-making and accelerate business growth.

- Clear Visualization: Present complex data in an appealing, understandable format.

- Actionable Insights: Transform data into actionable guidance for strategic decisions.

- Customized Reports: Tailor dashboards to specific business needs and KPIs.

Application Design & Development

We combine cutting-edge technology, innovative thinking, and extensive industry expertise to create custom applications that drive growth and enhance user experiences. From conceptualization to implementation, our skilled team crafts intuitive and scalable applications that align with your unique business goals. Experience the power of transformative applications that propel your business forward and set you apart from the competition.

- Tailored Solutions: Custom applications to meet specific business needs.

- Enhanced User Experience: Intuitive and user-friendly interfaces.

- Scalability: Applications that grow with your business.

- Efficiency Boost: Streamlined workflows and automated processes.

- Data Security: Robust measures to protect sensitive data.

- Integration Capabilities: Seamless data flow and collaboration.

IOS & Android Development

Unlock business potential with our iOS & Android Development service. Our expert team creates captivating, high-performance mobile apps that engage users. Using cutting-edge tech and best practices, we deliver seamless experiences on iOS and Android. From concept to launch, we exceed expectations, reflecting your brand identity. Embrace mobile innovation and seize new opportunities.

- Cross-Platform Reach: Engage users on both iOS and Android devices.

- User-Centric Design: Create intuitive and visually appealing interfaces.

- Enhanced User Experience: Optimize app performance and responsiveness.

- Custom Functionality: Tailor app features to meet specific business requirements.

- Scalability: Build apps that can grow alongside your business needs.

- Seamless Integration: Integrate with existing systems and third-party services.

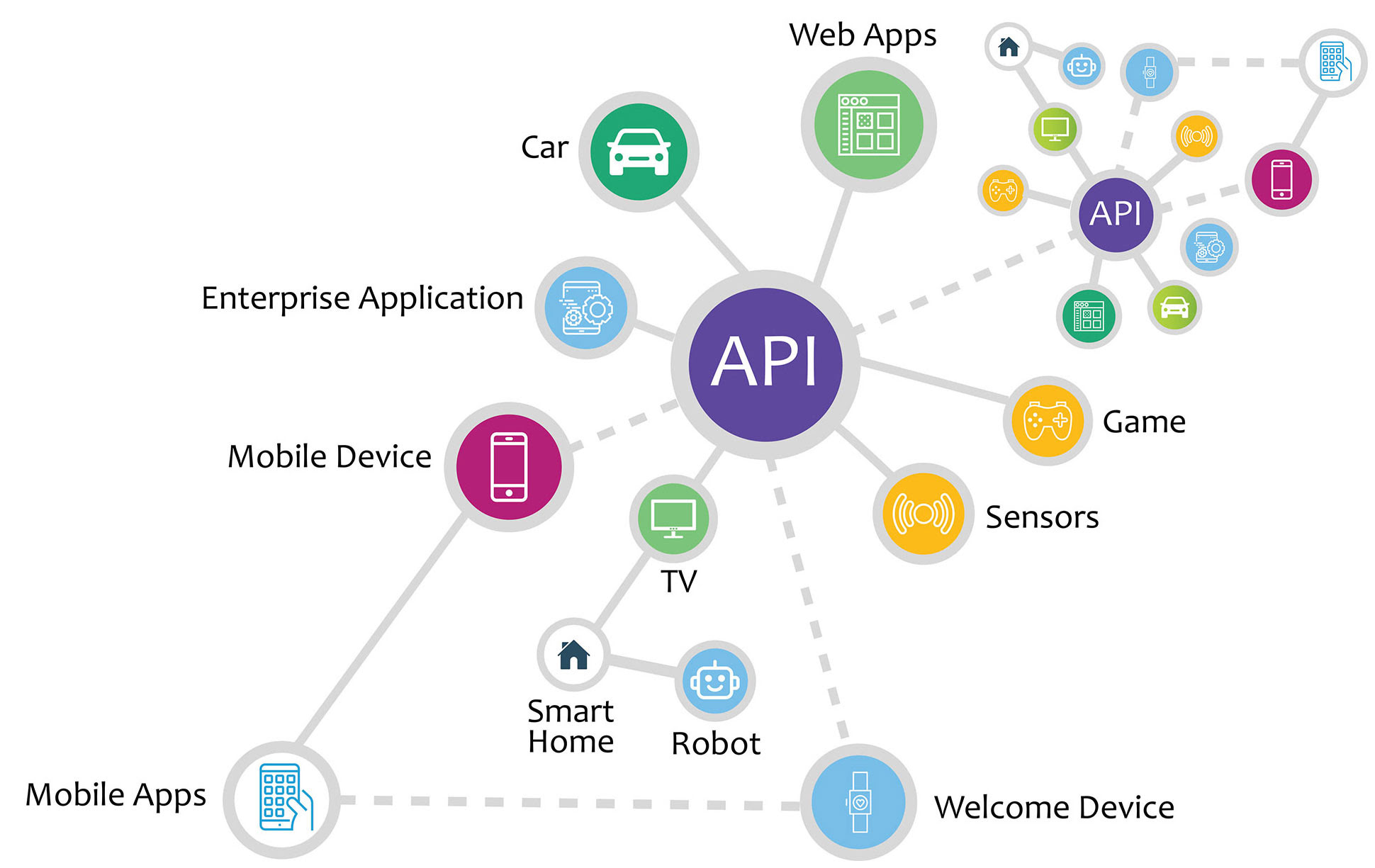

API & System Integration

Maximize the power of your systems with our API & System Integration service. We specialize in seamlessly connecting your applications, platforms, and databases to optimize workflows and enhance data sharing. Our expert team utilizes robust APIs and integration frameworks to ensure smooth and secure communication between systems, unlocking new efficiencies and enabling real-time insights. Experience streamlined operations, improved collaboration, and accelerated business growth with our API & System Integration service.

- Streamlined Workflows: Automate processes and eliminate manual data entry.

- Real-Time Insights: Access up-to-date data for informed decision-making.

- Enhanced Data Accuracy: Ensure consistent and accurate information across systems.

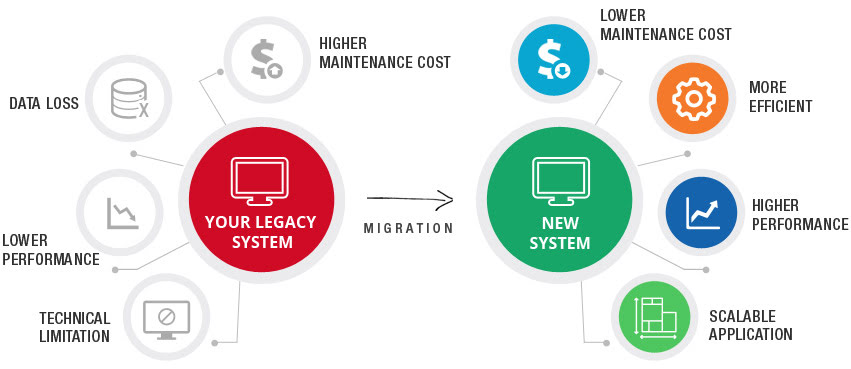

Technology Migration

Experience seamless transition and enhanced performance with our Technology Migration service. We specialize in migrating your systems, applications, and infrastructure to modern and efficient technologies, ensuring minimal disruption to your operations. Our expert team ensures data integrity, scalability, and optimized performance throughout the migration process. Unlock the full potential of your business with our Technology Migration service.

- Smooth Transition: Seamlessly migrate your technology stack without disruptions.

- Minimal Downtime: Minimize business interruptions and maintain productivity.

- Data Integrity: Ensure the integrity and security of your valuable data during migration.

Inspections

Experience excellence, trust, and peace of mind with our comprehensive suite of technical services. We specialize in providing top-notch inspection, verification, conformity assessment, and other essential services to industries across all sectors. Our unwavering commitment to quality and compliance ensures that risks are minimized, standards are met, and regulatory requirements are surpassed. Partner with us to unlock the true potential of your business and gain the confidence you need to succeed.

- Quality Assurance: Ensure products meet high standards, reducing recalls.

- Compliance Confidence: Identify and rectify non-compliance, avoiding penalties.

- Cost Savings: Early defect detection saves on repairs and delays.

- Customer Trust: Build confidence and enhance brand reputation.

- Peace of Mind: Focus on core operations, knowing compliance is assured.

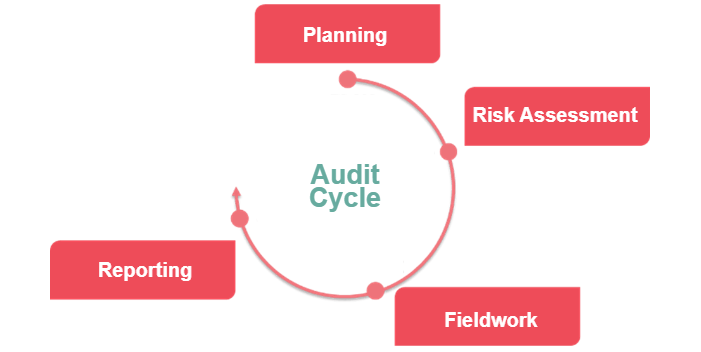

Audit & Assessment

Elevate your business with our Audit and Assessment service. Our expert team conducts comprehensive analyses, providing valuable insights and practical recommendations. Identify strengths, weaknesses, and growth opportunities while mitigating risks. Streamline operations, ensure compliance, and make informed decisions for sustainable success.

- Comprehensive Analysis: Gain valuable insights and a holistic view of your business.

- Identify Strengths and Weaknesses: Uncover areas of excellence and opportunities for improvement.

- Actionable Recommendations: Receive practical and effective strategies for growth and optimization.

- Risk Mitigation: Identify and address potential risks and vulnerabilities in your operations.

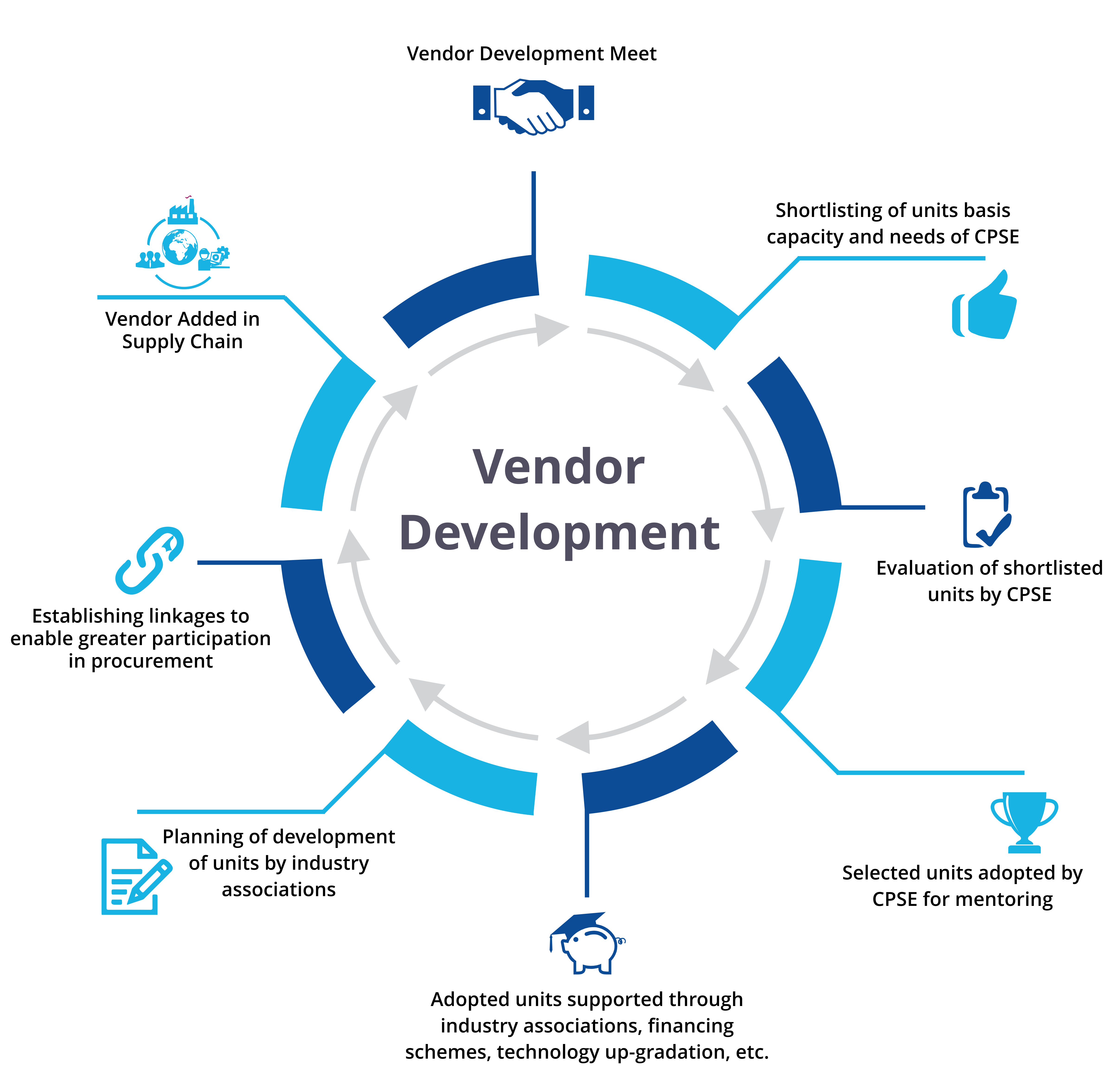

Vendor Development

Unlock the potential of strategic partnerships with our Vendor Development service. We help you build a robust network of reliable suppliers and partners to support your business growth. Our experienced team conducts thorough evaluations, ensuring that vendors meet your quality, cost, and delivery requirements. By leveraging our expertise, you can enhance your supply chain efficiency, reduce costs, and foster long-term partnerships. Experience seamless vendor development and elevate your business to new heights.

- Reliable Suppliers: Build a network of trusted suppliers who meet your quality standards.

- Cost Optimization: Identify vendors offering competitive pricing and cost-saving opportunities.

- Timely Delivery: Ensure on-time delivery of goods and services, avoiding production delays.

- Supply Chain Efficiency: Streamline your supply chain for improved operational efficiency.

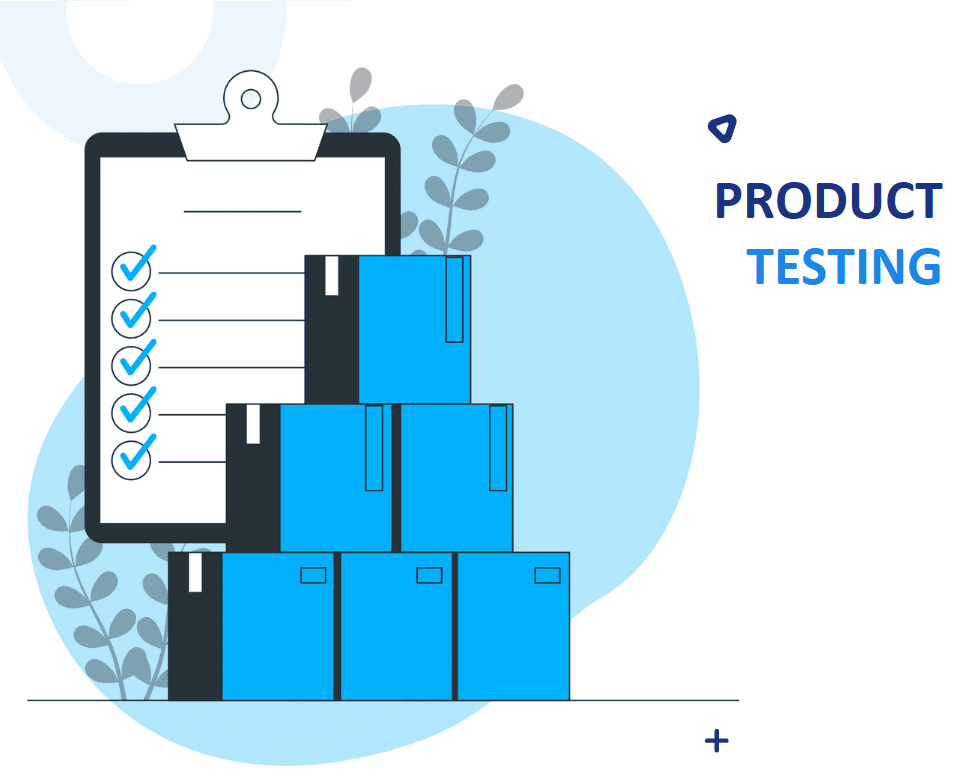

Testing & Verification

power of flawless performance and reliability with our Testing & Verification service. We provide comprehensive support in knowledge, competence, and manpower to ensure your organization's products, systems, and processes meet the highest quality standards. Our expert team utilizes cutting-edge techniques and tools to conduct rigorous testing, uncovering any potential defects or vulnerabilities. By leveraging our service, you can enhance customer satisfaction, minimize risks, and gain a competitive edge. Trust in our expertise to validate your products and achieve excellence.

- Quality Assurance Support: Ensure products meet stringent quality standards, exceeding expectations.

- Risk Mitigation: Identify and rectify defects, minimizing risks.

- Compliance Assurance: Validate regulatory and industry-specific requirements.

- Reliable Performance: Build trust with well-tested products.

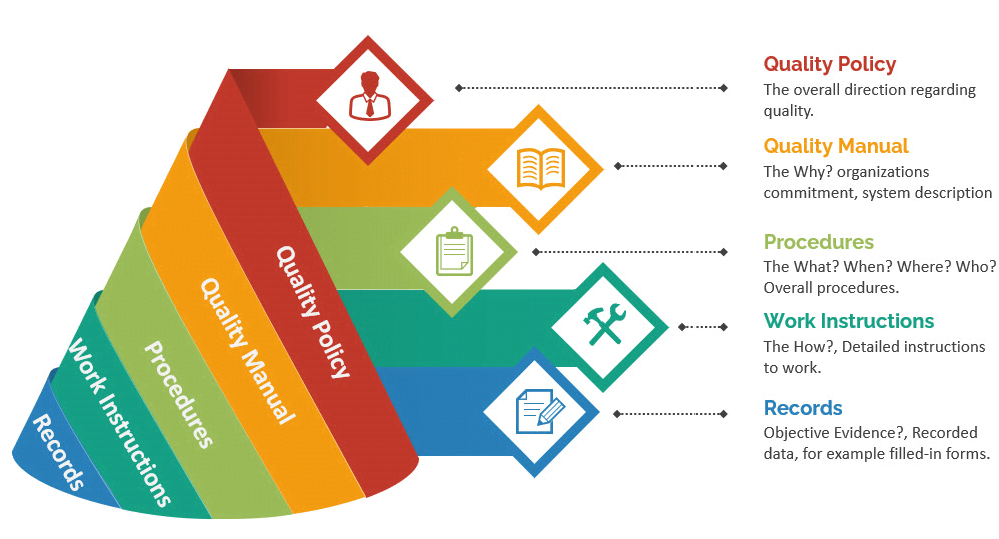

Quality Documentation

Comprehensive quality documentation with our specialized service. We provide end-to-end solutions for creating, organizing, and managing quality documentation to ensure compliance with industry standards and regulations. Our experienced team utilizes advanced tools and methodologies to deliver accurate and reliable documentation, enabling you to streamline processes, enhance transparency, and achieve operational excellence. With our Quality Documentation service, you can instill confidence in your stakeholders, maintain regulatory compliance, and elevate your brand reputation.

- Compliance Assurance: Ensure adherence to industry standards and regulatory requirements.

- Streamlined Processes: Simplify workflows and improve efficiency through organized documentation.

- Enhanced Transparency: Facilitate clear communication and accountability across teams.

- Improved Quality Control: Maintain consistent quality standards and reduce errors.

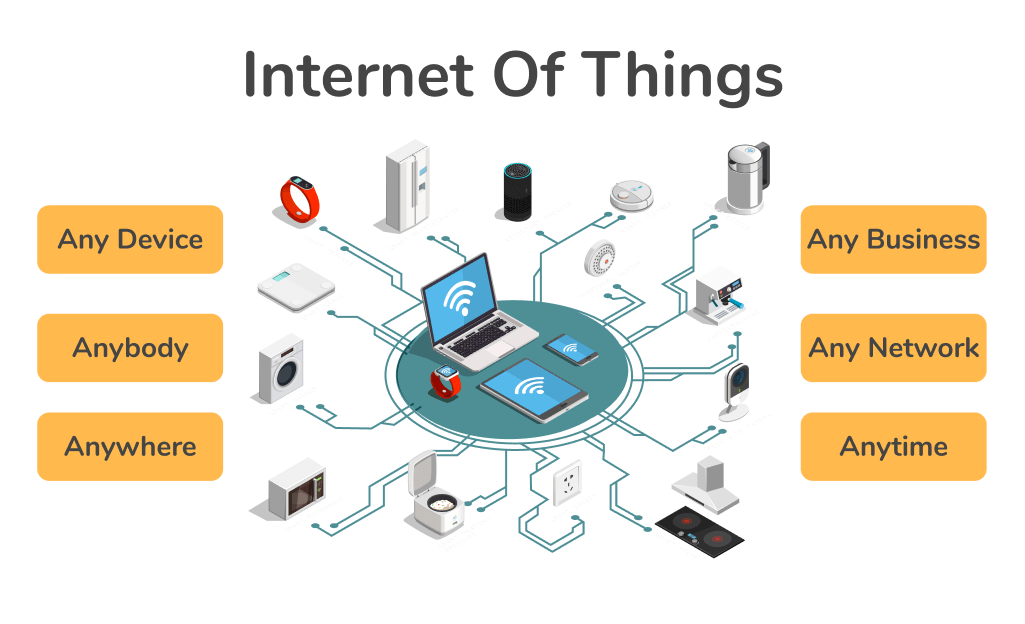

IoT 4.0

We offer end-to-end solutions that harness the power of IoT to transform your business operations. Our experts design and deploy IoT systems tailored to your specific needs, enabling real-time monitoring, data analytics, and automation. Experience enhanced efficiency, productivity, and cost savings as you connect and control your devices seamlessly. With our IoT service, you can make data-driven decisions, optimize processes, and gain a competitive edge in today's digital landscape.

- Real-time Insights: Gain instant visibility into device performance, usage patterns, and operational data for informed decision-making.

- Improved Efficiency: Automate tasks, optimize workflows, and streamline operations to enhance productivity and reduce manual effort.

- Enhanced Safety and Security: Monitor assets, detect anomalies, and mitigate risks to ensure a safe and secure environment.

Technology Stack

Discover what INDAS can do for your business organization right away

- Automate your process activities and get results today

- Save precious time and invest it where you need it the most

About INDAS

INDAStek Pvt Ltd is an innovative EngiTech Company specializing in cutting-edge Engineering & IT products and services. Our focus is on delivering bespoke solutions that exceed client expectations.

Our solutions are built on two core principles:

- Cost competitiveness: We provide value for our clients through competitive pricing without compromising quality.

- Timely delivery: We prioritize efficiency to meet project deadlines, ensuring prompt delivery of solutions.

Blog

Recent posts form our Blog

Revolutionizing Industries: IoT Solutions for Cost-Effective Problem Solving

Introduction: In today's rapidly evolving world, industries face unique challenges that demand innovative solutions. One technology that has emerged as a game-changer is the Internet of Things (IoT).By seamlessly connecting devices and leveraging data, IoT...

Read More

Enhancing Industry Efficiency: Unleashing the Power of the SMART Visitor Management Solution

In the fast-paced world of industry, optimizing operations, ensuring security, and fostering seamless visitor experiences are paramount. Traditional visitor management systems often fall short, leading to inefficiencies, compromised security, and increased costs...

Read More

Maximizing Business Compliance and Risk Mitigation: The Power of Third-Party Inspection Agencies

In today's competitive and rapidly changing business landscape, maintaining compliance and mitigating risks are critical for sustained success. However, investing in internal competency development can be time-consuming, costly, and challenging to keep up with market demands...

Read MoreContact Us

Discover what INDAS can do for your business organization right away...

Get in touch

INDAStek Private Limited

Registered Office : 18, Janaadhar, Shram Marg, Gujarat International Finance Tec-City (GIFT City), Gandhinagar - 382355 Gujarat, Bharat (India)

Regional Office : M-503, Wondercity, Katraj, Pune – 411046, Maharashtra, Bharat (India)